Energogarant Insurance Company

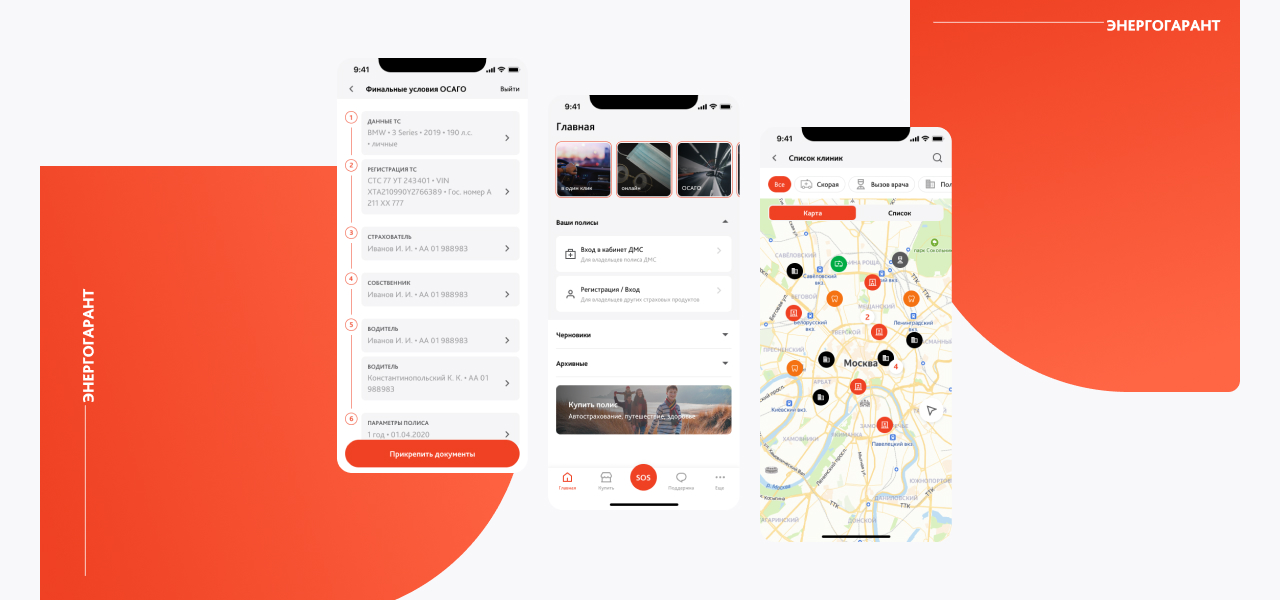

Mobile application. On Flutter

Clients

Insurance company PJSC SAK Energogarant is the largest insurance company in Russia. In 2020, the company set itself the task of large-scale digitalization of services. Friflex has become a partner in this. Having developed digital web services for the insurance company, we started developing a mobile application.

Task

Before the company’s clients had an application, they received services offline and had to call or go to the office. There was a need for a solution that would become the main a new sales channel, allow users to be informed about products faster and more efficiently, and would generally increase user engagement. It was necessary to solve the following tasks:

- Provide customers with the opportunity to view all purchased insurance products through a single personal account in a mobile application;

- Provide customers with the opportunity to issue a CTP insurance product;

- Provide customers with the opportunity to pay for the franchise in the insurance product "VMI franchise".

Solution

We got down to the tasks with great enthusiasm and focused on the following requirements:

- The system interacts with the company's current automated information system (AIS).

- Users can log into a single personal account, where all purchased insurance products for the last 5 years will be displayed.

- Users can pay the deductible under their VMI policy.

- Users can issue and pay for the CTP policy.

How we worked on the project

Work on the application for the insurance company "Energogarant" consisted of the following stages:

- planning,

- choice of technological stack and system analysis,

- interface and data models development,

- development,

- testing and debudding.

Other insurance companies have similar applications: we previously studied their interface and operation.

Why Flutter?

Choosing a tech stack for development, we always focus on the needs of the business. We look at how technologies can help speed up processes, optimize costs, and simplify interaction within the team. We don't just write code, but solve the client's tasks taking into account deadlines, budget and set goals.

Application development on Flutter gives businesses a number of advantages. The development cost and time are significantly reduced by creating a common code base for two platforms. This allows saving up to 40% of the budget. Using Flutter guarantees high stability and performance of the application, as well as the same user interface and business logic on two platforms. It is much cheaper and easier to maintain one Flutter application than two different products for Android and iOS.

About our team

In the work on the application for Energogarant our analyst, designer, backend developer, two Flutter developers and two QA engineers were involved. We worked in a team with the client — product managers, developers of the company's processing system, and underwriters participated in the project from the insurance company. Without our close cooperation, it would hardly be possible to achieve a good result in a short time. Colleagues from Energogarant took an active part in the project, contributed ideas, solved business issues, and were involved in testing.

Challenges

The insurance industry, like any other, has its own nuances: there are a lot of types of insurance services, each of them has its own business features that require close attention and communication with a number of underwriters at the same time.

Besides, one of the project tasks was to adapt the system to the already existing processing system of EnergoGarant, which was also adjusted as the application was developed.

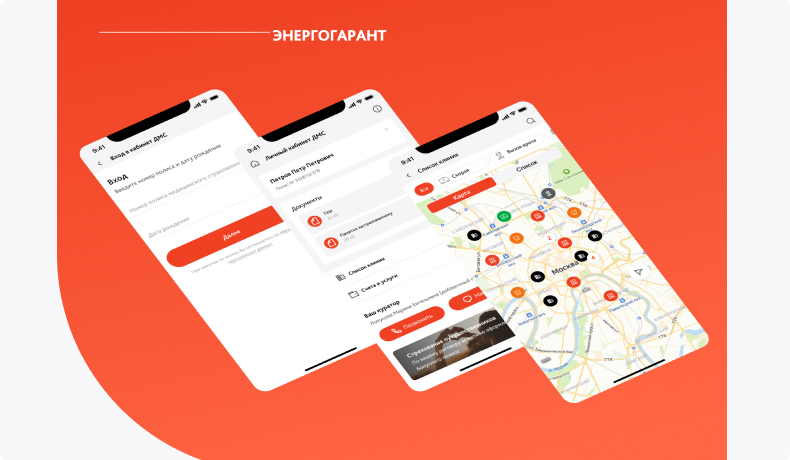

There was also an interesting case with a VMI product. Our task was to work out and show the specifics of the product, which has a number of business features in the context of b2c.

VMI, or voluntary medical insurance, is issued at the request of a policyholder. The latter is an organization that insures its employees. Since policyholders in the VMI are not individuals, but legal entities, the logic of the VMI cabinet was built differently than the logic of other automated insurance products of the company (other products were automated due to the websites that we developed). As a result, a VMI account was created, which exists separately from a single personal account.

The VMI cabinet is the most popular service of the project. Clients use it most actively.

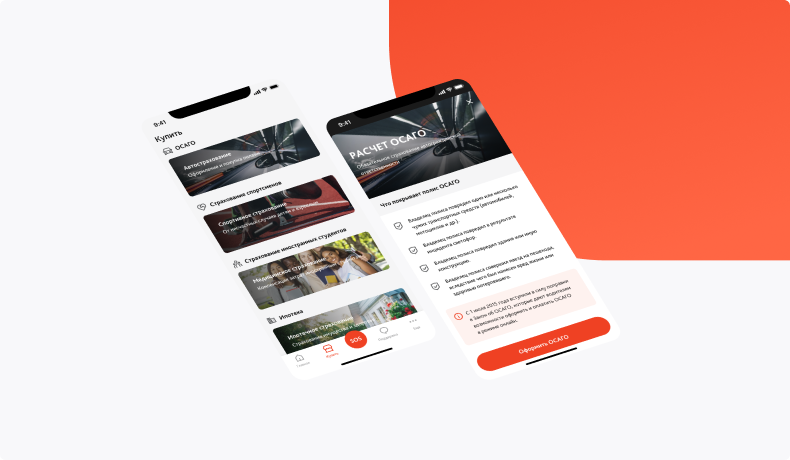

To increase flexibility of the application, we have implemented special marketing tools to manage commercial blocks of the application directly from the administrative panel. These are special sections that can be managed by marketing so as to attract the attention of mobile application users to insurance products:

- onboardings (screens that are shown when the application is started for the first time),

- the "Buy" section (which contains a list of some insurance products),

- stories (кwhich can also be used to report any news).

Also, you can manage information for internal products through the administrative panel. For example, you can add vehicle brands and models for CTP or types of interstory floors for mortgage insurance.

Results

As a result of our work, an application has been released for existing and potential clients of the insurance company, which allows you to:

- get information about the insurance products of the company,

- track expiration dates of active policies,

- use the personal account of the VMI to view the list of clinics under the contract and pay franchise bills.

Also, in the course of the work, updates and expansion of functionality were made on the side of the existing automated information system of the company.

It was not an easy task to adapt the AIS capabilities to the pool of tasks that the application was supposed to solve. But in the end everyone was satisfied: the product evokes interest, clients want to use it. Colleagues from Energogarant notice:

- decrease in the number of clients requests to the company’s office,

- increase in sales figures by 50% since the release,

- timeliness of contribution payment on bills,

- increasing envolvement of employees in the automation of work processes;

- reduction in the costs of commissions by enabling payment via the Fast Payment System using a QR code (the commission for accepting payments via the Fast Payment System is several times lower than acquiring).

Further project development is planned.

-

“The digitization of the policy issuance process has significantly increased sales figures for many products: Sports Accidents, Student Care and others. We scale this solution into other insurance products, where the factor of operational registration and provision of insurance is important. Thanks to Friflex solutions, Energogarant offers its customers a modern, convenient, reliable service, the implementation of which is reflected in the growing sales figures for insurance products, where Friflex solutions are used”.

More cases

CrossConf

Mobile app for offline conference CrossConf

idChess

حل مبتكر باستخدام الذكاء الاصطناعي للتعرف على ألعاب الشطرنج والبث المباشر لها